September 5, 2025

The 3-2-1 Lending Strategy: Smarter Diversification on SoLo Funds

School is in session. Today, we’re going to talk about one of the most important lessons every SoLo lender needs to master: how to diversify your lending approach so your returns are steady, your risks are balanced, and your participation helps strengthen the entire SoLo marketplace.

Whether you’re lending $100 or $100,000, the way you deploy your money — and how often you have to manage it — makes all the difference. That’s where the 3-2-1 Lender Strategy comes in. It’s a tested framework used by top-performing SoLo lenders, and by the time you finish this article, you’ll be able to walk away with a clear playbook for yourself to do more on SoLo Funds.

Why “3-2-1” Matters for Portfolio Performance

Think of 3-2-1 as three “lending personalities” that help you understand how to do your best on SoLo. These depend on:

- How much capital you bring.

- How often you’re willing to open the app.

- How comfortable you are with balancing risk, impact and return.

This framework is not about locking you into one rigid style — it’s about giving you the language and structure to choose your own strategy. Some people stick to one strategy, while others blend them together into a well-diversified portfolio approach.

In a classroom analogy: the “Daily Player” is like the student who’s deep in the library every night, the “Balance Scorer” shows up consistently to class but without burning out, and the “Impact Builder” is the student who gets good passing grades with steady effort but leaves more time for other things in life.

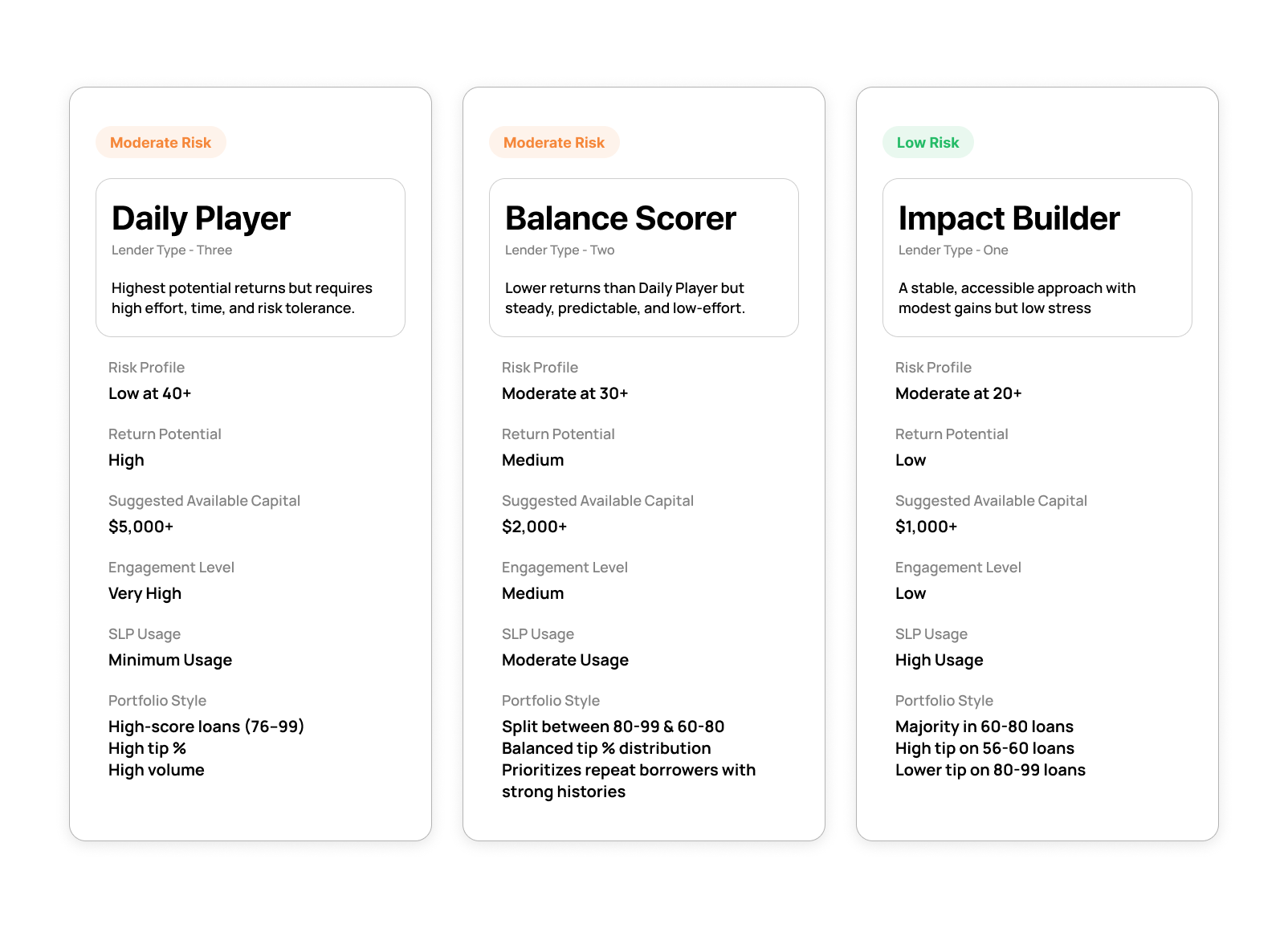

1. The Daily Player

This is the “all in” strategy — high focus, high capital, best returns.

- Risk Profile: Low (SoLo Score 70–99)

- Returns: Best

- Capital Suggested: $5,000+

- Engagement: Very high (10+ daily opens)

- SLP Use: Minimal

Portfolio Style: Chasing high-score borrowers with strong repayment histories and high tips.

Traits of a Daily Player:

- You’re constantly scanning the marketplace.

- You target maximum upside and often beat other lenders to the best loans because of how often you are on the app.

- For some, SoLo can become an additional income stream rather than just a side hustle.

Tradeoff: It requires a lot of time, attention, and quick reactions. Inventory can be competitive, so you’ll need persistence.

Classroom note: If you’re someone who loves trading stocks in real time or refreshing dashboards, this style may fit your personality. With the launch of SoLo IQ, you might be even more empowered in this method.

2. The Balance Scorer

Here’s the steady middle ground.

- Risk Profile: Moderate (SoLo Scores 60–99 with an even spread across all the scores in that range)

- Returns: Good , steady

- Capital Suggested: $2,000+

- Engagement: Moderate (3–5 daily opens)

- SLP Use: Moderate (~40-60%)

Portfolio Style: A balanced diet of high-score and mid-score loans, mixing tips and protection.

Traits of a Balance Scorer:

- You value stable returns without heavy commitment to using the app.

- You like diversification — spreading your risk across a variety of loans.

- You use SLP as a safety buffer, but not exclusively.

Tradeoff: Your returns won’t be as good as a Daily Player, but you’ll sleep easier at night knowing your portfolio is steady and growing.

Classroom note: Think of this as the “honors student” approach — steady, reliable, doesn’t need the spotlight, but always delivers.

3. The Impact Builder

For those who want to engage, make an impact without the stress.

- Risk Profile: Moderate (SoLo Score 56+)

- Returns: Average to moderate

- Capital Suggested: $1,000+

- Engagement: Low (once or twice daily)

- SLP Use: High

Portfolio Style: Lots of smaller bets across a wide pool of borrowers, at least 20 per month.

Traits of an Impact Builder:

- You’re here to be safe, steady, and impactful while growing your money.

- You lend smaller amounts more broadly across a variety of scores.

- It’s about participation, not perfection.

Tradeoff: Returns are more modest, but this approach is highly accessible and low-stress, especially for newer lenders.

Classroom note: This is like the student who takes the core classes seriously, but also has room for hobbies, sports, or family life. It’s not flashy, but it’s sustainable and it gets the job done.

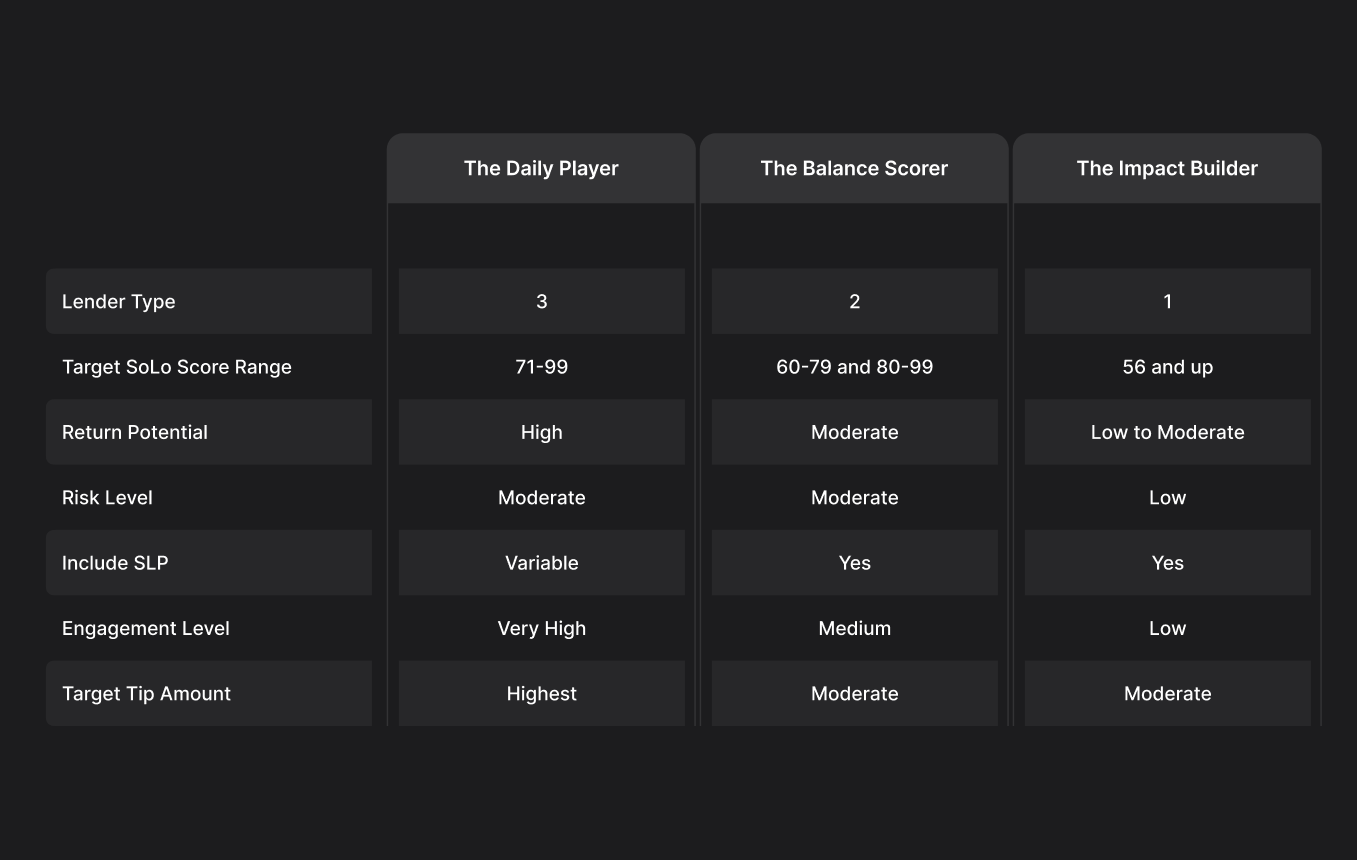

Comparison Table

| Lender Type | Score Range | SLP Usage | Engagement | Tip Target | Risk Level | Return Potential |

| Daily Player | 76–99 | Minimal | Very High | Highest | Moderate+ | High |

| Balance Scorer | 60–99 | Moderate | Medium | Balanced | Moderate | Medium |

| Impact Builder | 56+ | High | Low | Moderate | Low–Moderate | Modest |

Pro Tips for Success on SoLo Funds

Think of these as your classroom “study hacks”:

- Batch your lending: 20+ loans per month smooths out variance.

- With $1000, spread across 20 smaller loans — one delinquency won’t sink you.

- Prioritize:

- Tip % – Balance reward with risk.

- Duration – Shorter = less exposure.

- SoLo Score – Higher = stronger repayment.

- Borrower Story – Motivation & history matters.

- Tenure – Repeat borrowers are usually more reliable.

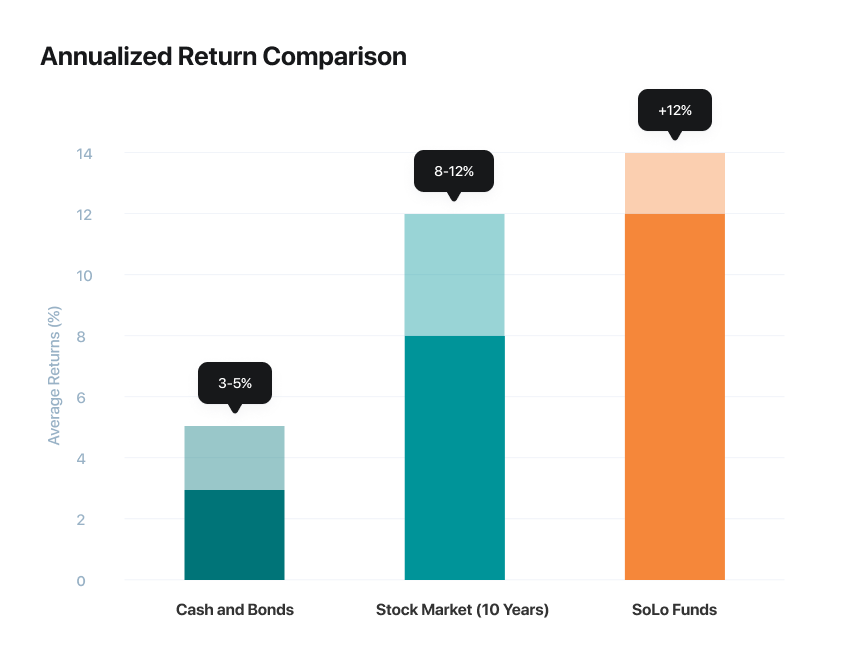

SoLo Funds vs. Traditional Investment Returns

Here’s how SoLo stacks up:

| Instrument | Annualized Returns |

| Cash & Bonds | 3–5% |

| Stock Market (10 yr) | 8–12% |

| SoLo Funds | +12%% via diversified lending average in 2023 |

Example: A diversified $1,000 portfolio across 20 loans could generate ~$120 in monthly returns — far exceeding CDs or savings accounts.

Classroom note: You’ve essentially built a high-yield mini-portfolio on your phone.

The Wealth Tech Advantage of SoLo

SoLo isn’t just peer-to-peer lending anymore — it’s part of Wealth Tech.

- Borrowers gain access without being tied to wages or penalized by banks.

- Lenders can grow wealth with real tools like SoLo Lender Protection (SLP).

- The entire system creates financial empowerment for both sides.

That’s what makes SoLo unique — you’re not just lending; you’re participating in a new asset class.

The Bottom Line: 3-2-1 Works

The 3-2-1 Lender Strategy is more than a framework — it’s a market-tested playbook for building wealth on SoLo Funds.

- Daily Player: High risk, high reward.

- Balance Scorer: Steady and reliable.

- Impact Builder: Accessible and safe.

And remember: the best lenders aren’t just making money; they’re helping real people access opportunity, which in turn breeds even more opportunity for lenders. That’s the future of Wealth Tech — and SoLo is where it starts.

Want to dig deeper into fees, risks, and SoLo’s unique difference? Read: