THE 2025CASH POOR REPORT

2025 Key Findings

The 2025 Cash Poor Report:

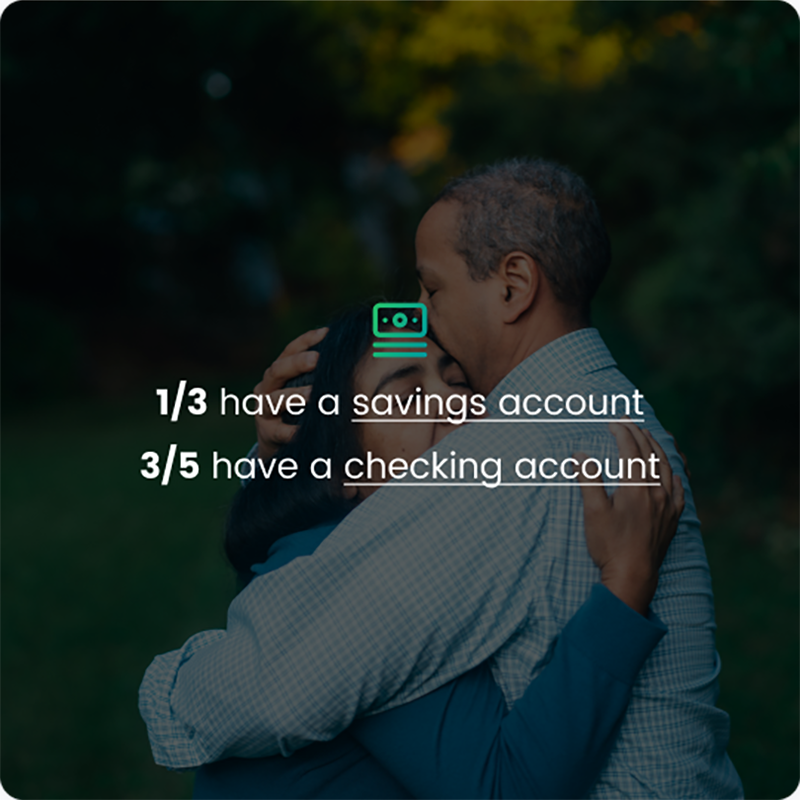

Most Americans are middle class, working, and Cash Poor living paycheck to paycheck. This is a fact that continues to be true. Our 2023 Cash Poor report welcomed a fresh perspective on this consumer, their total cost and options they have to make ends meet. The 2025 report continues its mission.

The 2025 Cash Poor Report was conducted in partnership with Opinium Research, Pace University, The Global Black Economic Forum, The Aspen Institute Financial Security Program, SoLo Funds and the Independent Women’s Forum. The resulting report, concluded by Professor Tamir Harosh from Pace University, provides much needed understanding of this group of Americans and determines the total true cost of borrowing for Cash Poor Americans aka the middle class.

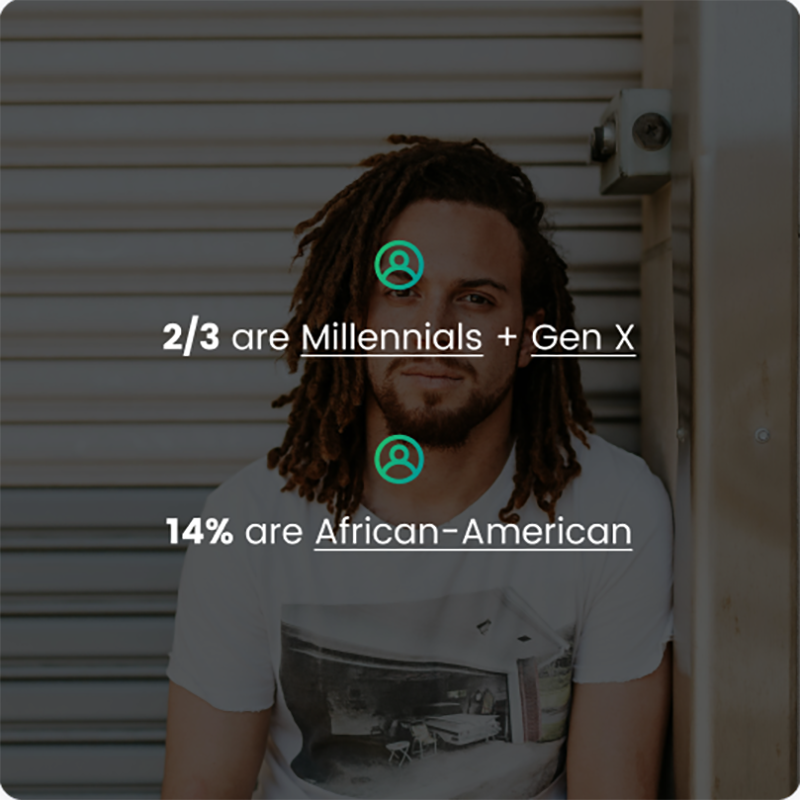

The study surveyed a U.S. representative sample of American adults spanning Gen Z, Millennials, Gen X, Boomers and the Silent Generation. This year’s report revealed this group of Cash Poor Americans paid more than $39 billion dollars in fees–beyond the advertised Annual Percentage Rate (APR)–when seeking short-term capital, a 34% increase from 2023. Subprime credit cards emerged as the most expensive option again, while fintechs as a whole continued to rank as the most affordable options for the second consecutive year.